Save Now, Pay Later.

With flexible payments from handypay.

Save Now, Pay Later.

With flexible payments from handypay.

Published

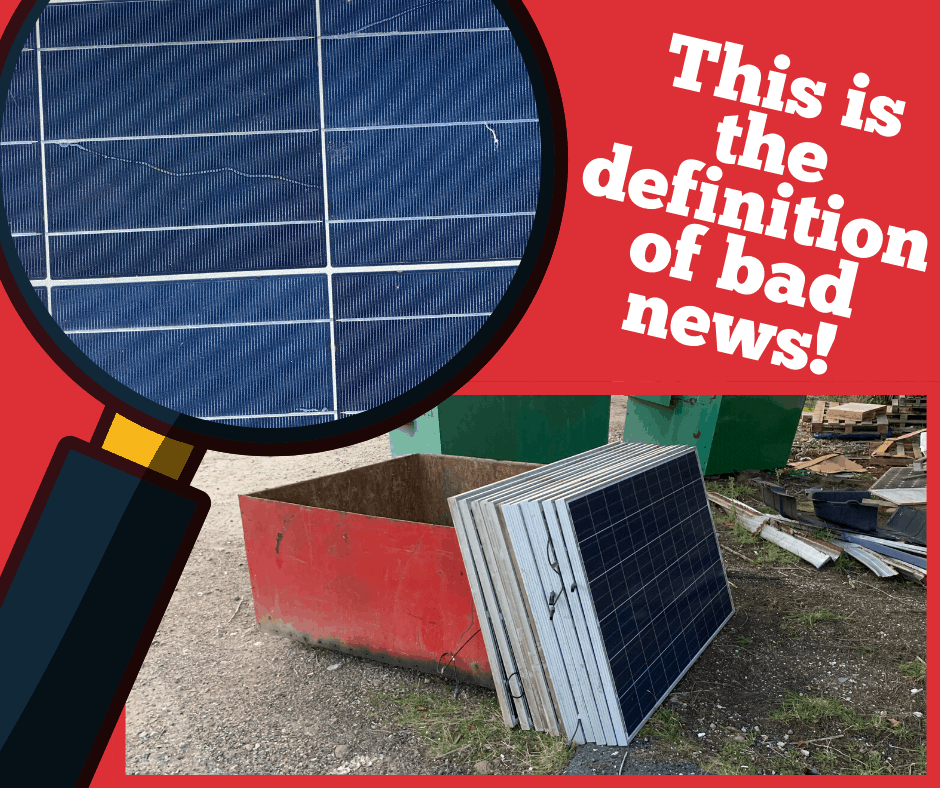

Late last week we had to remove a solar system that was only 6 years old. We had to replace all the panels as they had gone down to earth and had stray DC voltage on the roof. The panels were kaput and the roof was live (electrified). The supplier and installer had disappeared and the panel manufacturer was not around either for support.

This isn’t an uncommon tale, especially now we see these cheap and nasty Facebook and TV solar ‘specials’ put a few years under their belt. I think we have talked about the “if-it’s-too-good-to-be-true” scenario, it generally isn’t enough and most people out there are now wise enough to know to avoid these pitfalls of these ‘wonderful’ deals.

But we have also talked about solar being a marathon not sprint, and I thought I will discuss last week’s example and try to explain why this is the particular calculation that is largely missed by most customers.

This particular system was installed in late 2013 and as such had access to the 5 years of 28 cent legacy feed in tariff (which ended in January 2020) and as it was a 3kW system so in this will be easy to calculate. A system this size would average around 10.5kWh per day or save $2.94 per day. With the feed in tariff of 28 cents this was around $1000 per year of savings.

The client paid around $5,000 for it, so at the beginning of 2019 it had broken even. We don’t know how long the system had been playing up for, but these sort of panel faults do not develop overnight as they begin faulting occasionally until the system is a continuous fault. But let’s assume it worked correctly till the beginning of 2019. We could quite easily assume 2019 was a year of sporadic production and only generated 50% of what is could have produced. So it may have saved the client $500 before 2020 came along and the panels were finally toast.

Thus, they had invested $5000 to save $500 over the 6 years.

Now let’s play the numbers out using quality panels with genuine warranties and after sales support, also with panels built to such a high standard of quality that a possibility of a premature failure is a near impossibility.

The crap panels lasted 5 to 6 years and saved the customer $500.

If they were quality panels then 25 years is the accepted minimum life span. In fact most of our products’ warranty this as the minimum period. LG NeON2 panels are warranted to be still doing over 90% of their output in 25 years and they have a 25 year build warranty as well.

The better quality panels would have been about $1000 more expensive so the system would have paid for itself in 6 years instead of 5 year. But still had a minimum of 19 years of energy production left in them.

Even with the loss of the legacy feed in tariff in 2020, the daily savings would have still been in the vicinity of $2 per day, multiply that by another 19 years would have returned a whopping $13,870 at the current electricity prices, back into the clients pockets. However power prices only go up and every time they go up, the value of the electricity you produce goes up with it. If we were to apply some compound interest of 1% per year over those 19 years it's easily another couple of thousand dollars of profit in your pocket.

This client mentioned at least it paid for itself but really when you look at what he gained to what he got installed, he was robbed by shysters. Dodgy solar is a the worlds slowest con job, as by the time you realise you’ve bought a dud, all the players have left the table. It also cost $4000 to replace all the panels so now we have a new figure to consider. Minus the $500 it had saved them, this site still owes him $3,500. Luckily, the replacement panels are quality QCELLS panels which will last the distance and if the unthinkable happens, they are well supported by a multi-billion dollar company.

A 3 kW system is a very small system by today’s standards, with systems between 5k and 10kW now being the norm these days. So if you apply what you have now learnt about the potential earnings and losses of a small 3kW system to the potential earnings and losses on a bigger solar system, you can see the how fraught with danger the cheapies are.

This is why buying from reputable local companies like DMS Energy who have invested 13 years of time and lots of money to source the right products for our clients, is virtually risk free. Our research means we actually offer rock solid renewable investments not stabs in the dark with mystery box products. Our reputation relies on us getting it right and given 30% of our work these days is replacing or repairing orphaned, low quality solar systems, indicates there are a lot of people getting it wrong.

Photos of last week’s tale of woe can be seen our Facebook page.

Stick local and remember DMS Energy have done all the research so you don’t have to.

Simple, Low Rate Green Loans

Introducing award winning finance provider, Handypay, to bring you the most Competitive, Flexible and Versatile finance solution available in the home improvement industry today!

We have partnered with Handypay so customers can access a simple, affordable green loan for their solar panels and home batteries. Get a no-obligation quote and pre-approval in minutes, not weeks.

DMS Energy strives to Honestly, Ethically and Accurately assist Tasmanians to meet their energy reduction goals.

DMS Energy have advised countless locals on the right energy solutions for their home’s and business’s.

DMS Energy are not your typical energy efficiency salesmen! We are long time locals offering expert advice on solutions that are tailored to your individual needs. Talk to one of our experts today.